A: The dividend is paid to all consumers on Unison’s electricity network in the Hawkes’s Bay district as of 30 September 2023.

A: This year the eligibility date is 30 September 2023.

A: All permanent metered supply points (ICPs) connected to Unison’s Hawke’s Bay network, and which are liable for a fixed daily charge as at 5pm 30 September 2023, are entitled to a dividend payment. There is a maximum of three payments for any one named consumer (even if you have more than three ICPs).

Note: Builder’s temporary supplies, and other unmetered connections such as streetlights, telecommunications devices, and under-veranda lighting are excluded.

A: This year the dividend is the same for all ICPs (regardless of whether it is a commercial or a domestic installation) and is $240 after tax. This amount was decided by the HBPCT.

A: The amount is calculated by the Trust from the dividend it receives as majority shareholder of Unison Networks Ltd. A dividend from Unison’s profits is paid to the Trust by Unison and most of this is passed on by the Trust to our beneficiaries.

A: From Tuesday 17 October 2023, you should have received an email, text message or a postcard asking you to confirm if the bank account details you provided last year are still correct. If everything is correct, you don’t need to do anything. If you have changed your bank account or moved house, please click the link to update your details online, we encourage everyone to check their registered details are correct to ensure you receive your payment on time. If you did not receive an email or postcard, please call 0800 535 738.

A: Your payment will be made to the bank account you provided last year. If the bank account is incorrect the bank will dishonour the payment and return this to the Trust within 5 business days. We will do our best to get in touch with you when we become aware of the dishonour. If you haven’t received payment by Friday 1 December 2023, please call 0800 535 738.

A: Direct credit payments will be made from 24 November 2023 into your bank account if you have registered on time. Please be patient, however if you haven’t received payment by Friday 1 December 2023, please call 0800 535 738.

A: Your ICP number is a 15-character alpha/numeric number located on your power bill. If you cannot find the ICP on your power bill, please contact your power retailer.

A: Because banks no longer receive or issue cheques, all dividends will be paid by direct credit into your bank account. This is the only option available.

• If you previously registered for direct credit, you should receive an email, text message or a postcard on Tuesday 17 October 2023 asking you to confirm your bank account details are correct. If you don’t confirm your details, your payment will be made to the bank account you provided last year. If you haven’t received payment by Friday 1 December 2023, please call 0800 535 738. If you did not receive an email, please call 0800 535 738.

• From Tuesday 17 October 2023 all beneficiaries who had not registered for direct credit previously were mailed a six-digit pin number and the steps on how to register. This enables you to register online to have your dividend paid directly to your bank account.

• If you did not register by Thursday 16 November 2023, your payment will be withheld until such time written confirmation of your bank account has been received. You can still register your details online, but payments to beneficiaries supplying bank account details after the cut-off date will be made weekly depending on volume.

• The name on the bank account must match the name on your power account. If you need to change the name on the power account, please contact your electricity retailer.

A: Make sure the bank account number shown on your payment advice is correct. If this is not correct, we need to investigate to see if the bank dishonoured the payment and rejected it back to the Trust’s bank account.

If it is correct, you need to ask your bank if it is possibly sitting in a UPI (unpaid items) account with the bank. This sometimes happens if your bank couldn’t process the payment right away.

A: If you have had to relocate from your property due to damage caused by Cyclone Gabrielle you may still be eligible for the dividend payment.

If you:

– are connected to power at a new address you will be entitled to a dividend payment through your new connection and should receive a notification from Tuesday 17 October 2023, asking you to register your details.

– are not reconnected to power at a new address, please call a Trust Representative on 0800 535 738 to discuss your situation.

A: If you have not placed a redirection order with NZ Post, and you did not provide an email address previously, your dividend communication will be returned to us. If you have moved to another property in our coverage area, we should be able to locate your forwarding address and re-send the dividend communication to your new address.

Alternatively, if you have moved recently and wish to advise us of your new address, please email hbpct@linkmarketservices.com. This year the Trust has also sent communications by email, so we recommend checking the email address where your power bill is sent.

A: You will follow the same process as those who are not on pre-pay. All pre-pay beneficiaries – who did not sign up for direct credit last year – will be mailed a registration card from Tuesday 17 October 2023 with a six digit pin to enable them to register online at www.hbpct.co.nz/register. Pre-pay beneficiaries who registered for direct credit last year will be sent an email asking them to confirm their details.

A: The communication regarding the dividend will be sent to the person who is the power account holder. It is up to the people responsible for the power account to decide how the payment is shared in this instance.

A: The dividend is paid to the power account holder. It is up to the people responsible for the power account to decide how the payment is shared in this instance.

A: The dividend payment will apply only to those accounts that normally have a fixed distribution charge, i.e. those identified as a primary network connection point. Payments will be made only to a maximum of three connections (ICPs).

A: This is an annual decision that will be made by the Trust.

A: A single fixed eligibility date was chosen for the dividend payment to aid with the administration of payments, as all data relating to customer eligibility is provided by the electricity retailers.

A: All permanent metered supply points (ICPs) attracting fixed daily charges as at 5pm on 30 September 2023 are entitled to a dividend payment. Note: Builder’s temporary supplies, and other unmetered connections such as streetlights, telecommunications devices, and under-veranda lighting etc. are excluded.

A: The Trust made the decision that the dividend payment would be the same for every consumer, regardless of size, spend or consumption.

A: You will need to discuss this with a local bank as you require a bank account to receive your dividend payment by direct credit.

A: Your details are held on file for shutdown notices, billing, and other operational purposes of the network company.

A: As required by the Inland Revenue, the Trust pays tax at the rate of 33% on the dividend. We believe many beneficiaries are on a lower tax rate than 33% so you could be entitled to a tax refund on this payment if you file a tax return.

Any questions in regards to your tax situation must be discussed with Inland Revenue as we are not qualified to comment or provide any tax advice. Visit www.ird.govt.nz or call Inland Revenue on 0800 227 774.

A: The Trust pays 33 cents of tax credits to every dividend payment. We believe many beneficiaries are on a lower tax rate than this so you could be entitled to a tax refund on this payment if you file a tax return.

Any questions in regards to your tax situation must be discussed with Inland Revenue as we are not qualified to comment or provide any tax advice. Visit www.ird.govt.nz or call Inland Revenue on 0800 227 774.

A: A copy of the of the standard tax certificate is available online at hpbct.co.nz. A copy of the tax certificate for those with an RWT-exempt certificate is also available on hpbct.co.nz

A: Because everyone has different tax rates, we are not able to provide calculations for the tax on a share of the dividend. You will need to ask your tax advisor or Inland Revenue. Visit www.ird.govt.nz or call Inland Revenue on 0800 227 774.

A: If you have an IRD certificate of exemption from RWT, you can contact our customer team on 0800 535 738 in the first instance. You will be asked to provide a copy of that certificate and your dividend will be paid without withholding tax being deducted.

If the dividend has already been calculated for payment, or paid, you will need to claim the tax back through your tax filing. You will need to ask your tax advisor or Inland Revenue. Visit www.ird.govt.nz or call Inland Revenue on 0800 227 774.

A: Hawke’s Bay Power Consumers Trust owns 100% of Unison shares on behalf of Unison customers.

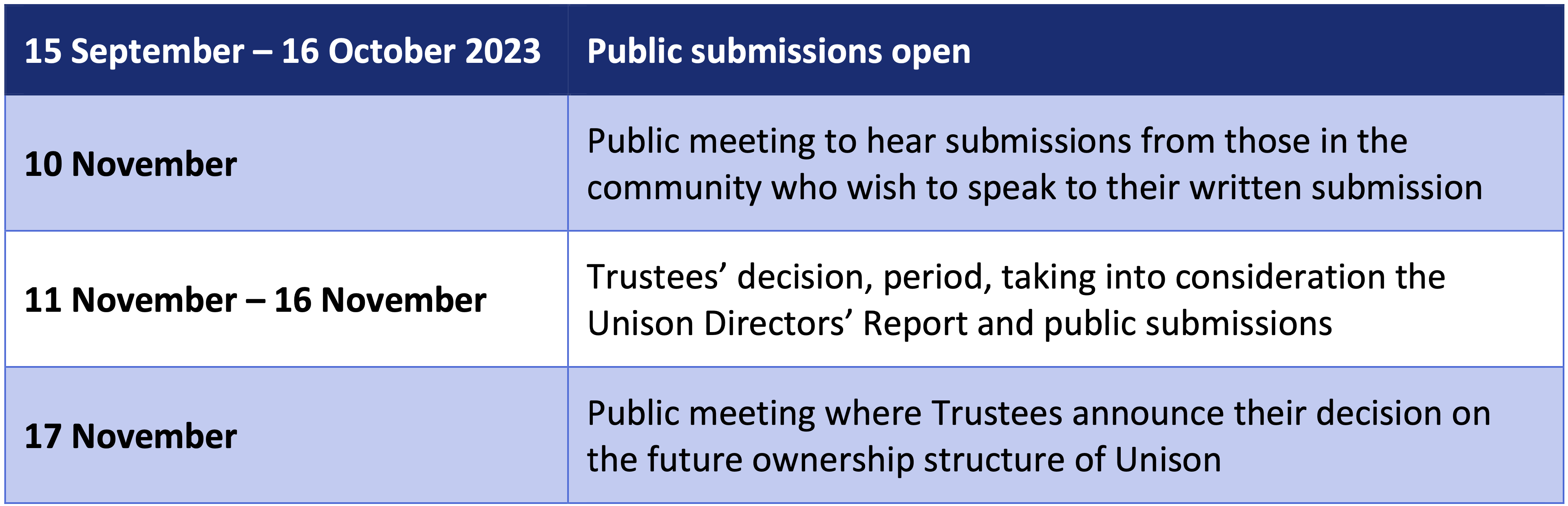

A: The ownership review happens every five years and is part of the rules that govern the ownership of Unison, set out in the Hawke’s Bay Power Consumers Trust Deed.

A: Section 4 of the Trust Deed describes the process that must be followed as well as the alternative ownership options to be considered.

A: Price Waterhouse Coopers (PwC) has completed the review of Unison’s performance for the company in accordance with the Trust Deed. PwC reviews alternative ownership options and reports on the performance of Unison and the performance of Unison Networks relative to other electricity distribution network companies.

A: Yes.

A: The Trust Deed requires directors of Unison to prepare a report that considers proposals and available options for the future ownership of the company. PwC prepares its report for Unison and Unison’s report to Trustees incorporates the PwC report as well as the directors’ recommendation of the most appropriate form of ownership for the company.

A: There is a lot of information in both reports, and we encourage people to read them. But the key outtake from the PwC report is that “Unison has performed well as a consumer owned business”. The key outtake from the Unison Directors’ report is that “Unison Directors unanimously support retention of HBPCT ownership”.

A: The Trust Deed requires that power consumers have the opportunity to express their views on Unison’s ownership, at each five-yearly review.

A: On the HBPCT website: www.hbpct.co.nz The PwC report is an appendix to the Unison Directors’ report.

A: You can make a written submission to Trustees following which you can present your views to Trustees in person at the public meeting.

A: You can make a written submission to Trustees, following which you can present your views to Trustees in person at the public meeting.

A: You can make a written submission to Trustees, following which you can present your views to Trustees in person at the public meeting.

A: The Trustees consider the views of the public and Unison Directors. The Trustees can decide to:

• Retain the shares in Unison in the Trust

• Dispose some or all of the shares in Unison.

A: Trustees make their decision once the submission period has ended and after the public meeting to hear submissions from those in the community who wish to speak to their written submission. There will be a public meeting on 17 November where the Trustees will announce their decision.

A: No, it is speculative. There is no evidence to support any share valuation that has been or might be touted.

A: There is no market currently in which Unison shares could be sold. To create one would require Unison to become publicly traded on the New Zealand Stock Exchange. This would cost millions of dollars.

We encourage people to read the Unison Directors’ report, and the PwC report that the Unison report is partly based on. Both are available at www.hbpct.co.nz. Alternative ownership options are a key part of the review. Having considered these, Unison Directors are unanimously in favour of continuing with HBPCT ownership. The Trustees will consider the views of the public and Unison Directors, when they make their decision about the future ownership structure of Unison.